Business Insurance in and around Gulf Breeze

One of Gulf Breeze’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

Whether you own a an art gallery, a fabric store, or a hair salon, State Farm has small business protection that can help. That way, amid all the various decisions and moving pieces, you can focus on making this adventure a success.

One of Gulf Breeze’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

Your business thrives off your tenacity passion, and having great coverage with State Farm. While you do what you love and support your customers, let State Farm do their part in supporting you with business owners policies, artisan and service contractors policies and commercial auto policies.

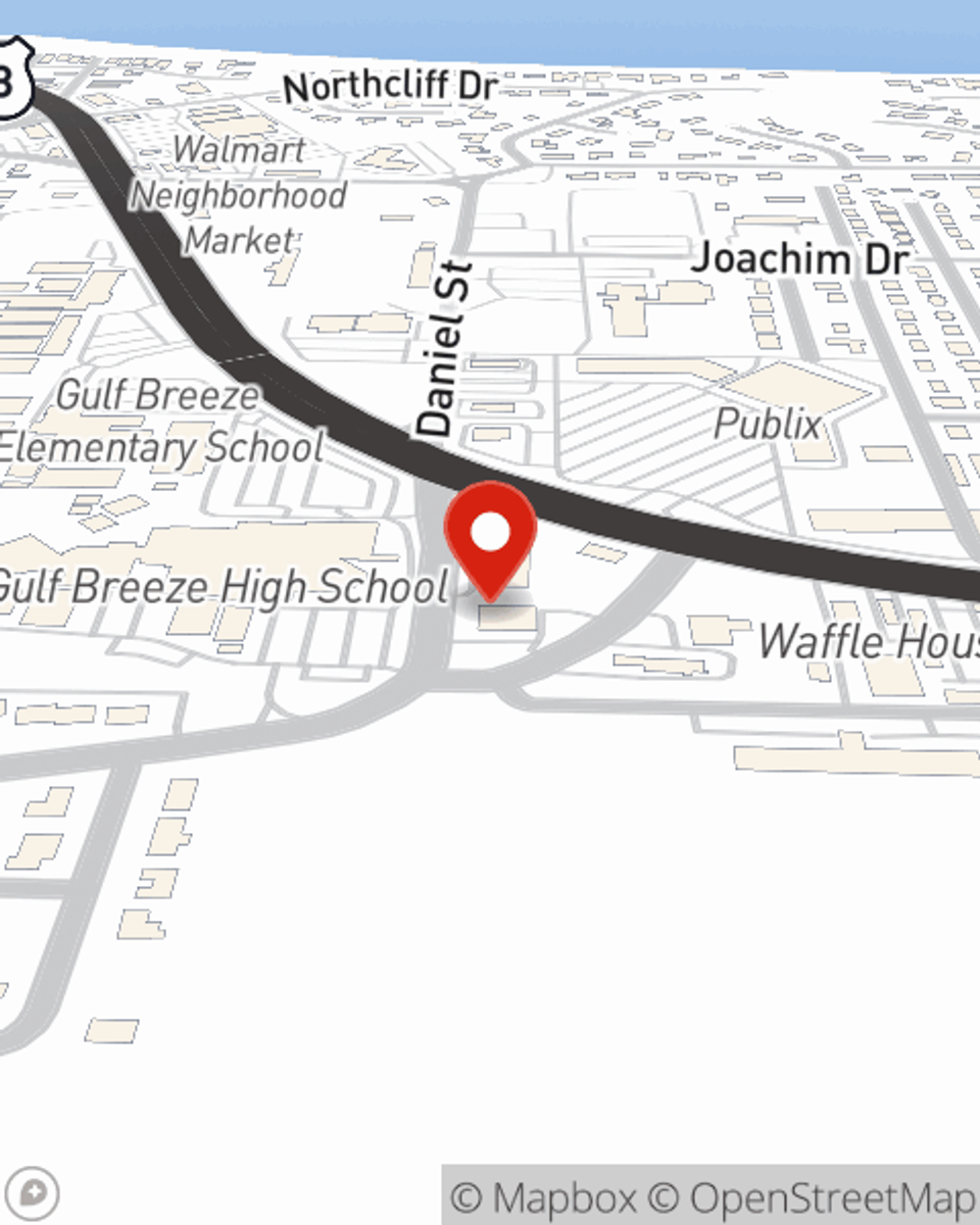

Let's review your business! Call Will Rentschler today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Will Rentschler

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.